santa clara county property tax credit card fee

The approved changes took. Santa clara county property tax credit card fee Sunday August 28 2022 Edit.

Credit Card Debit Card Service Fees Oc Treasurer Tax Collector

Clara Old License And Certificate Of Marriage Signed By Brenda Davis Marriage Signs Lease.

. Santa clara county property tax credit card fee Sunday July 3 2022 Edit. There is no fee for internet payments in Santa Cruz County. Business and personal property taxpayers in Santa Clara County now have access to SCC DTAC.

Business Tax Fee Amount. Credit Card American Express Discover MasterCard Visa 225 with 200 minimum. Valuation Based Fee Table for Building Permit Review.

For example LA County. 0 Down VA Loan. The fee to use a credit card will vary based on your county but theyre almost always at least 2 and often more than 25 of the total tax amount.

100 disabled veterans may be eligible for an exemption of up to 150000 off the assessed. 1110 of Assessed Home Value. Valuation Based Fee Table for Building Permit Review.

The 20222023 Secured Annual property tax bills are expected to be mailed starting October 1 2022. The median property tax in Barry County. Property Tax Fee Amount.

Enter Property Parcel Number APN. In Santa Cruz County a home is worth 711000 on average with 54 of the assessed value subject to property tax. Valuation Based Fee Schedule.

A non-refundable processing fee of 110 is required in Santa. Important changes have been made to the San José business tax which was approved by San José voters on November 8 2016. We accept payments of cash checks and credit cards Subject to transaction fee.

What are the property taxes in Santa Clara County. Review and pay your property taxes online by. There is an internet payment fee charged in addition to the property tax amount you pay.

0740 of Assessed Home Value. 0720 of Assessed Home Value. Electronic Check eCheck No Fee.

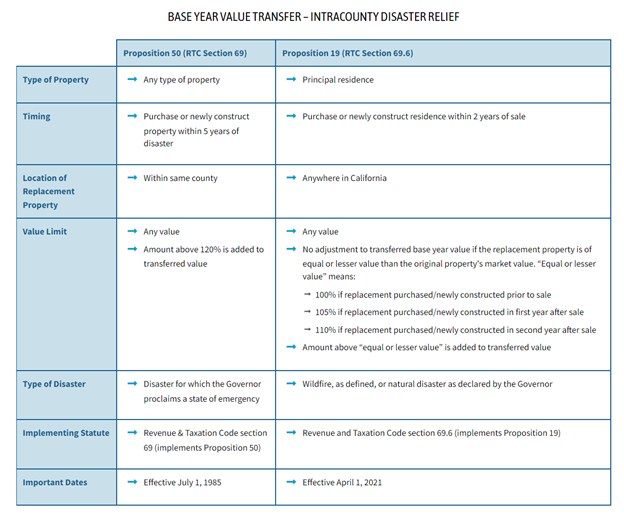

Application forms for Proposition 19 are required to be submitted to the Assessor in which the replacement property is located. Santa Clara County 1800. City of Santa Clara Municipal Utilities PO.

Confidential Marriage License 8300 Pay with cash check or creditdebit card 250 convenience.

Property Tax Installment Plans Treasurer And Tax Collector

Innovation At Work Scclab County Of Santa Clara

Property Tax Payment Instructions Department Of Tax And Collections County Of Santa Clara

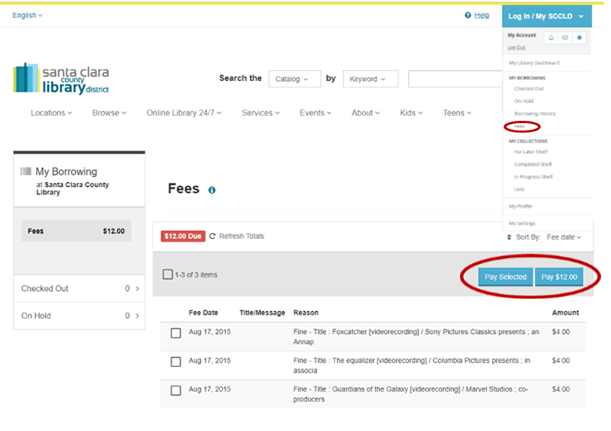

Pay Fees Or Donate Santa Clara County Library District

Standards And Services Division

Property Tax Calculator Smartasset

California Is Expanding Tax Credits Thousands Who Need It Most May Not Claim Them

Santa Clara County Supervisor George Shirakawa Challenged By Finances In Public And Private Life The Mercury News

Santa Clara County Federal Credit Union

What Is A Homestead Exemption California Property Taxes

Property Tax Calculator Smartasset

Los Angeles Bankruptcy Lawyer For Credit Cards Ca Attorney

Joshua Basin Water District Civicmic Outreach And Public Engagement

Alameda County Property Tax 2022 Ultimate Guide To Alameda County Oakland Property Tax Rates Search Payments Dates

Secured Property Taxes Frequently Asked Questions Treasurer And Tax Collector

Property Tax Payment Treasurer Tax Collector

Job Opportunities Sorted By Job Title Ascending Superior Court Of Ca County Of Santa Clara